Prenatal child support, death certificates, tax credits, and life insurance

Abortion proponents sometimes claim that a family grieving miscarriage did not lose an unborn child but only “a pregnancy” or a “clump of cells.”

The clump of cells narrative is not only callous but also ignorant to centuries of scientific discoveries by embryological pioneers like Dr. John Burns (Burns’s Obstetrical Works, 1809), Dr. John B. Beck (An Inaugural Dissertation on Infanticide, 1817), Karl Ernst von Baer (Ovi Mammalium et Hominis Genesi, 1827), Dr. Hermann F. Naegele (A Treatise on Obstetric Auscultation, 1839), Dr. Hugh Hodge (On Criminal Abortion, 1854), et al. The scientific and medical foundations laid by them and other pioneering men and women eventually gave rise to the modern Carnegie stages, which are so detailed in their descriptions of gestational development that it is baffling anything resembling a “neo-quickening” movement can exist in the modern age.

Those claiming unborn children are not human beings until arbitrary points often disregard the science and instead cite a lack of recognition of legal personhood as justification for their beliefs. Among the most common declarations are that (1) unborn children do not yet qualify for child support, (2) unborn children cannot receive certificates of birth or death, (3) parents cannot claim tax deductions for unborn children, or (4) parents cannot claim life insurance on stillbirths. These claims are inaccurate. I will address each of them here.

I hope this information helps provide resources to parents who have suffered a prenatal loss, and that we see expansion of these protocols to more states.

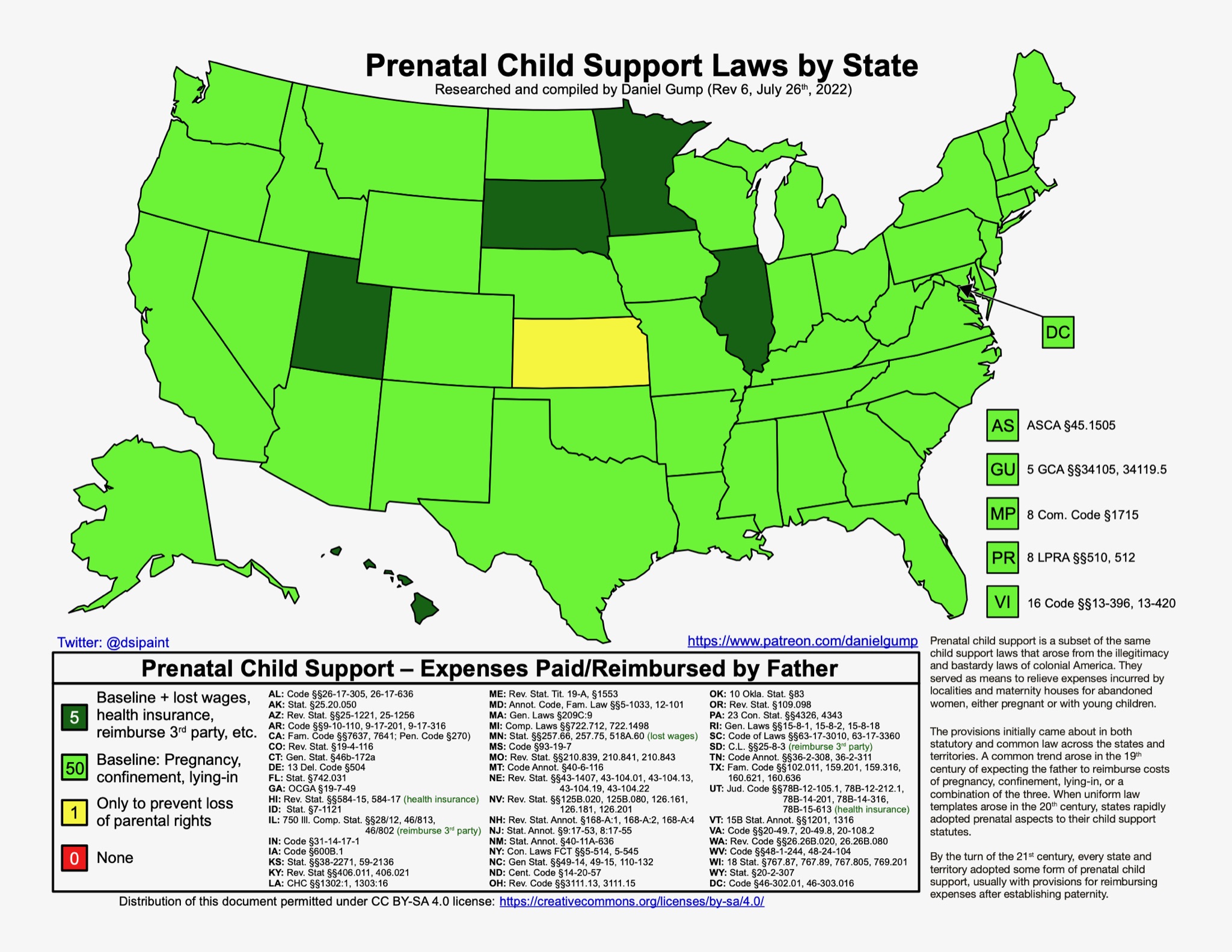

Prenatal child support

I have previously written several articles and a book on the topic of prenatal child support, so here I will touch on the topic just briefly before focusing on the other items. In short, the concept of prenatal child support has existed for a while in the United States: not just years, not just decades, but centuries. Georgia and Pennsylvania have required fathers to pay for a portion of the mothers’ prenatal expenses within child support laws since the late eighteenth century. Eleven states had such laws by the close of the nineteenth century, and every state and territory has such a law now (with the average year of enactment being 1920). The issue is that most states have prenatal child support laws so old that prenatal paternity testing did not yet exist, so the support payments still work on retroactive bases within all states except those where legislatures have revised the laws in recent years (such as Hawaii and Utah).

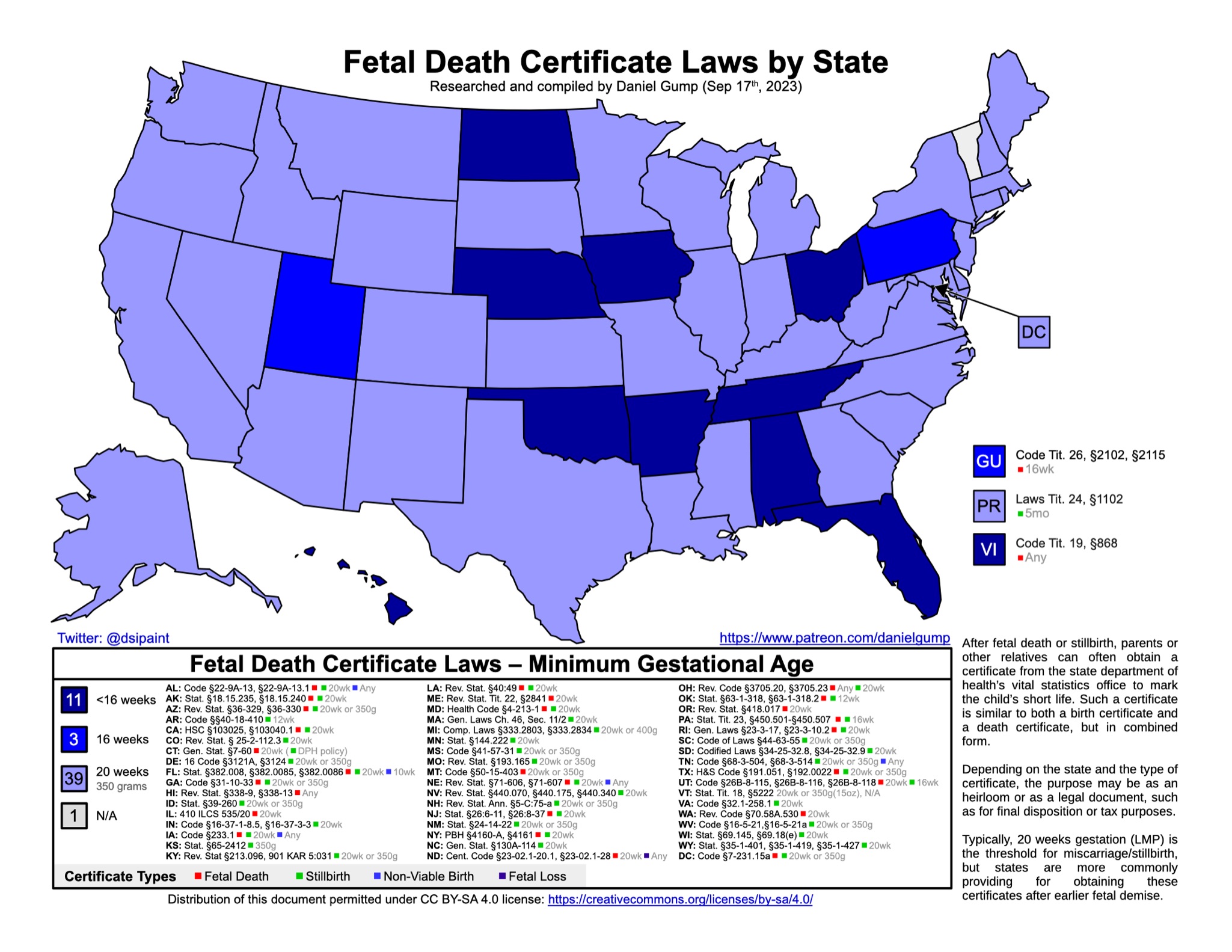

Fetal birth and death certificates

The next claim is that unborn children are not yet alive because it is not possible to obtain birth certificates or death certificates for them. This is also incorrect, as every state except Vermont offers some form of official document upon miscarriage or stillbirth of the unborn child, whether that document is a fetal death certificate, a fetal loss certificate, a certificate of birth resulting in stillbirth, a certificate of non-viable birth, or multiple of these types. (Vermont does still document vital statistics with stillbirths.) Of these certificates, two states plus Guam offer them from sixteen weeks gestation, and ten states plus the US Virgin Islands offer them earlier than sixteen weeks gestation.

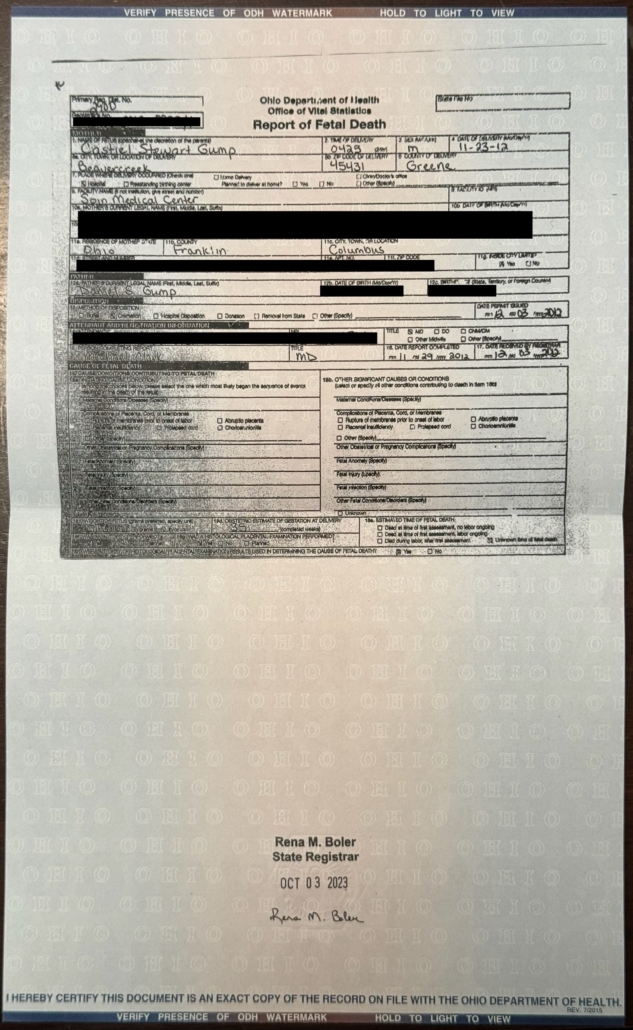

The fetal death certificate and fetal loss certificate may be directly derived from the report of fetal death provided to the State by the attending physician. These are very similar in format to death certificates produced for those who die after birth, and the details in these documents help state and Federal government agencies to tabulate vital statistics on rates and causes of fetal demise. For state departments of health that offer these certificates, families can order them in person or online through the vital statistics or records offices. Here is the report of fetal death my wife and I received in Ohio:

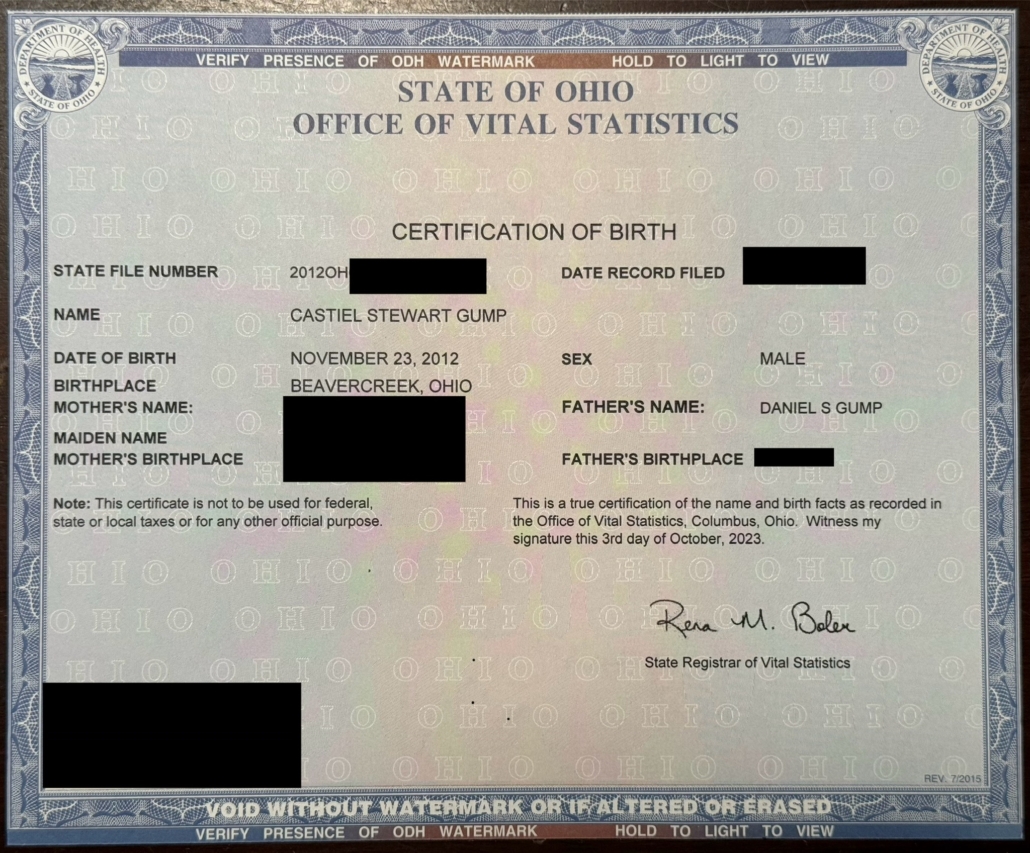

Depending on the state, there may also be a certificate of birth resulting in stillbirth or a certificate of stillbirth available. These often look similar or identical to the standard certificate of birth. However, states that only provide them for heirloom purposes may include additional notes, such as Ohio’s statement, “This certificate is not to be used for federal, state or local taxes or for any other official purpose.” A few states additionally offer a certificate of non-viable birth for fetal demise before twenty weeks. These also serve as heirloom documents.

Stillbirth tax credits and deductions

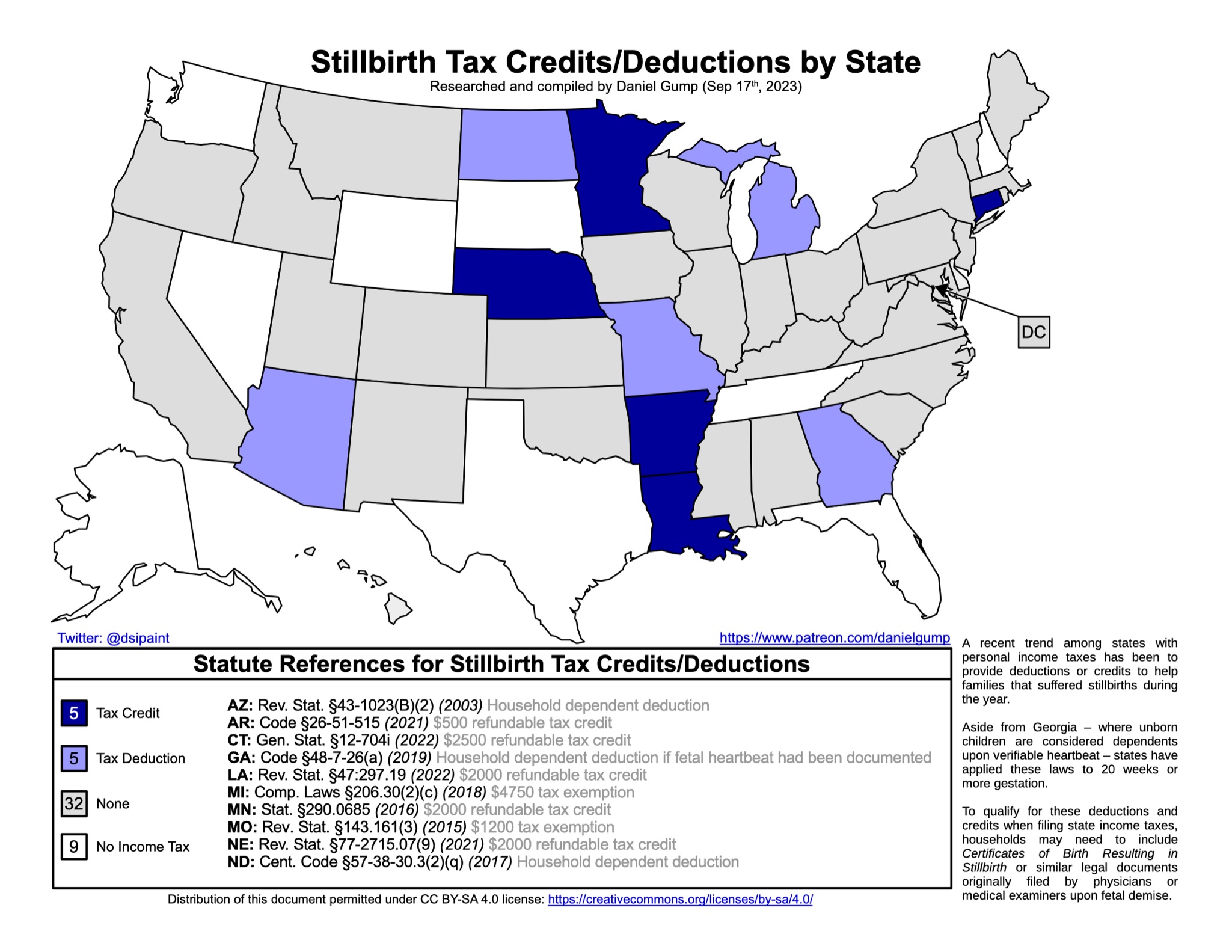

A recent trend among states, starting with Arizona in 2003, has been to provide state income tax credits or deductions for families suffering miscarriages or stillbirths. In such instances, one of these certificates may need to be included with tax filings. (Check your local laws for specifics.) At the time of writing this post, ten states with income taxes have such laws.

In Georgia, an unborn child is a legal tax dependent upon verifiable fetal heartbeat, so miscarriage or stillbirth any time after that would apply, and it also applies to ongoing pregnancies. The other nine states require twenty weeks gestation.

Fetal life insurance

The final claim was that unborn children are not alive because families cannot claim life insurance on their deaths. This is not a legal issue or a personhood issue. It is little more than a high-risk assessment and a determination that there is no insurable interest. Some insurers may not even cover infants for a few months after birth or individuals over certain ages or with certain health conditions, yet we don’t deny those classes of individuals are clearly alive.

That said, it may be possible to name an unborn child as the beneficiary for another individual’s life insurance. This idea of an unborn child being an eligible beneficiary originated in English common law and continued to receive acceptance in the United States, with the Massachusetts Supreme Judicial Court even affirming the premise in Hall v. Hancock, 32 Mass. 255 (1833), stating that, for the purposes of “descents, devises, and other gifts… a child is to be considered in being from the time of its conceptions, where it will be for the benefit of such child to be considered.”

Beyond the private sector, families in the armed services are able to include their unborn children in the Family Servicemembers’ Group Life Insurance (FSGLI) for $10,000 coverage. To file a claim, the unborn child must have reached at least twenty weeks gestation or weight of at least 350 grams. Anyone facing such a situation should contact FSGLI to determine which documentation is needed for filing such a claim.

[Read more – No, Pennsylvania is not fining women for miscarriages.]

If you appreciate our work and would like to help, one of the most effective ways to do so is to become a monthly donor. You can also give a one time donation here or volunteer with us here.